First Quarter Recap: Economic Growth & Pre-Election Insights

With the excitement of the total eclipse behind us and election season right around the corner, 2024 is already shaping up to be a year to remember.

At the close of the first quarter, economic growth remains robust with the unemployment rate near record lows and consumer spending showing no signs of slowing. Monetary policy continues to be a focal point for investors and the Fed has made it clear that the risk of waiting longer to cut rates is “significantly lower” than the risk of cutting too soon. As such, Fed members will wait to see inflation fall to the 2% target before cutting rates.

Elections will continue to play an important role in both domestic and international markets in 2024. Even though we find ourselves with familiar names at the top of the ticket, the inherent uncertainty of the moment has investors asking familiar questions: How should I position my portfolio if this candidate wins? What sectors should I avoid if that party is in control of Congress? What matters more — fiscal policy or monetary policy?

When it comes to predicting the financial landscape in months and years ahead, some would argue that history never repeats itself. However, more often than not, it does rhyme. That’s why at Tolleson, we find it helpful to use history as a guide when advising clients during seasons of uncertainty.

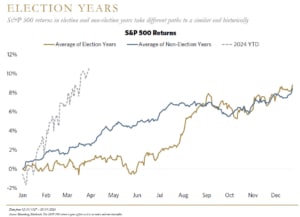

It is a popular misconception that stocks do not perform well during an election year, but the historical data suggests differently. And, while election years may be more interesting from a headline perspective, equity returns tend to fall in line with historical averages. In fact, the S&P 500 has produced double-digit returns in the last three presidential election years. This is where we see the old adage proven true time and again: The more things change, the more they stay the same.

Despite our best projections, there is no way to guarantee these results in any given year – especially after the S&P 500 was up 26% in 2023 – but even so, we believe it is important to keep your long-term investment goals in mind as you plan for the rest of the year ahead.

No matter the year, no matter the results in November, our team remains committed to helping our clients navigate any challenges or decisions, both near and long term.

General Performance Information: The performance results included in this presentation are actual returns which have been compiled by Tolleson Wealth Management (“TWM”). Individual investor returns may or may not be similar to the returns shown. The returns shown are based on index information and are strictly for illustrative purposes only. An investor cannot invest directly in the index shown. Investors should refer to their account statements for their actual return. Returns of this type may not show what impact material economic and market factors may have had on TWM’s decision-making at that time. Past performance is no guarantee of future results. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. All investments involve risk, including the loss of principal. These returns do not account for manager or other advisory fees that will impact a client’s overall return. A client’s return will be reduced by advisory and other expenses. TWM’s advisory fees are described in Part 2a of our Form ADV. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Opinions expressed are current opinions as of the original publication date appearing in this material only. Any opinions expressed are subject to change without notice and TWM is under no obligation to update the information contained herein. TWM disclaims responsibility for the accuracy or completeness of this report although reasonable care has been taken to assure the accuracy of the data contained herein. This material has been prepared and is distributed solely for informational purposes only and is not a solicitation or an offer to buy a security or instrument or to participate in any trading strategy. This report may not be reproduced, distributed or transmitted, in whole or part, by any means, without written permission from TWM. All portfolio and analysis herein constitute confidential and proprietary information and methodology of TWM. Disclosure of such information is prohibited. If you have any questions regarding this presentation, please contact your TWM representative.

Index Disclosure: The returns and volatility of the indices displayed may be materially different than the client’s account, and a client’s holdings may differ significantly from the securities that comprise the indices. The indices are disclosed to allow for comparisons to well-known and widely recognized indices, and may or may not be appropriate for performance comparisons. An investor cannot invest directly in the index.