Geopolitical Risks and Market Resilience

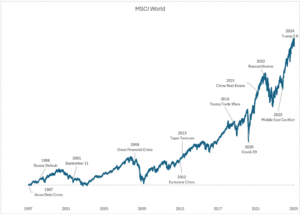

Geopolitical risks have always played a large role in shaping global financial markets, influencing investor sentiment, and driving volatility. However, history has shown that markets have an inherent ability to adjust, recover, and continue their upward trajectory over time.

In 2024, financial markets navigated significant disruptions, including the ongoing Russia-Ukraine war, Middle East tensions, and national elections in almost 70 nations across the world, with key votes being casted in the US, UK, India, and Mexico. Although there were numerous headlines throughout the year, markets concluded the year with positive results despite experiencing occasional volatility.

With new governments in place, 2025 will likely be driven by policy shifts and economic decisions. A key focus influencing the investment landscape globally right now is the discussions around trade policies and tariffs with the return of President Trump. While speculation around tariffs is high, their market impact will depend on corporate adaptability and regional trade dynamics. Thus far, the key developments include:

- A 25% tariff on Mexican and Canadian imports, along with an additional 10% tariff on Chinese goods, was initially set to take effect on February 1. However, its implementation was postponed by a month as negotiations between the U.S. and its trading partners unfolded.

- Meanwhile, China has enacted retaliatory tariffs on U.S. imports, while Canada and Mexico are weighing countermeasures and assessing potential trade restrictions in response.

These trade measures have already influenced market sentiment, prompting a downward pressure on equities as inflation becomes a growing concern. Corporate strategies are adjusting to the shifting trade landscape, with supply chain diversification and pricing adjustments becoming critical areas of focus.

Historically, tariffs have contributed to short-term inflationary pressures, a factor that could weigh on the Federal Reserve’s monetary policy decisions. Given the current uncertainty, markets are assessing the likelihood of delayed rate cuts if inflation trends higher. However, the broader economic impact will ultimately depend on how things play out between domestic policy decisions and global trade negotiations.

Disclosures: The performance results in this presentation have been compiled by Tolleson Wealth Management (“TWM”). Past performance is no guarantee of future results. No representation is being made that any account will or is likely to achieve profits or losses. All investments involve risk, including the loss of principal. A client’s return will be reduced by the advisory fees and other expenses. TWM’s advisory fees are described in Part 2a of our Form ADV. This information discusses general market activity, industry or sector trends, or other broad-based economic market or political conditions and should not be construed as research or investment advice. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Opinions expressed are current opinions as of the original publication date appearing in this material only. Any opinions expressed are subject to change without notice and TWM is under no obligation to update the information contained herein. TWM disclaims responsibility for the accuracy or completeness of this report although reasonable care has been taken to assure the accuracy of the data contained herein. This material has been prepared and is distributed solely for informational purposes only and is not a solicitation or an offer to buy a security or instrument or to participate in any trading strategy. This report may not be reproduced, distributed or transmitted, in whole or part, by any means, without written permission from TWM. If you have any questions regarding this presentation, please contact your TWM representative.

Index Disclosure: The returns and volatility of the indices displayed may be materially different than the client’s account, and a client’s holdings may differ significantly from the securities that comprise the indices. The indices are disclosed to allow for comparisons to well-known and widely recognized indices, and may or may not be appropriate for performance comparisons. An investor cannot invest directly in the index.