Investment Update

Fears from the spreading Coronavirus caused turmoil in the financial markets last week. The S&P 500 dropped 11.5% and is now down 8.5% for the year. Non-US stocks fared slightly better, with the MSCI ACWI-Ex US down slightly more than 8% for last week. While losses of this magnitude are normal over the course of any year, a loss like this in one week is not normal. Thus, we wanted to give you our thoughts.

We, along with many other professional investors, feel that the financial markets are overreacting. We do not believe that fears of the Coronavirus alone warrant a change in our investment approach. Markets have faced several health epidemics over the past decade – MERS in 2013 and Ebola in 2014, in addition to SARS back in 2003. Historically, these viruses have caused disruptions in economic growth and volatility in the stock market until there was a “light at the end of the tunnel” regarding control of the outbreak. After that, there was a snap back in economic growth and the financial markets. We believe there is a high probability the same thing will happen with the Coronavirus impact. We receive frequent updates from our managers in China who are close to the center of the situation.

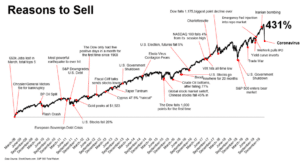

I also want to re-emphasize that losses of this size are to be expected and temporary in nature. Even last year when the S&P 500 was up 31% for the year, it experienced a 7% loss during that time period. The chart below shows several events that created anxiety in the financial markets over the past 10 years. You can see that while there are many ups and downs, the long-term investor was rewarded.

While it remains unclear how dramatic an impact the Coronavirus will have on global economic growth, we have and will always continue to be long-term investors focused on long-term results. In a time like this, it’s important to remember the critical role diversification plays in the context of a holistic investment portfolio. High-quality assets such as investment grade corporate and municipal bonds produced positive returns last week as investors sold equities and riskier high yield bonds. Many of our underlying managers used last week’s selloff opportunistically to find value and deploy excess cash. Our equity portfolios are positioned conservatively when compared to the broad market and we expect them to provide downside protection in times of market stress, as they are designed to.

You can reach out to our team using contact us or to anyone who serves you from our firm if you would like to discuss further.

General Performance Information

The performance results in this presentation have been compiled by Tolleson Wealth Management (“TWM”). Past performance is no guarantee of future results. No representation is being made that any account will or is likely to achieve profits or losses. All investments involve risk, including the loss of principal. This information discusses general market activity, industry or sector trends, or other broad-based economic market or political conditions and should not be construed as research or investment advice. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Opinions expressed are current opinions as of the original publication date appearing in this material only. Any opinions expressed are subject to change without notice and TWM is under no obligation to update the information contained herein. TWM disclaims responsibility for the accuracy or completeness of this report although reasonable care has been taken to assure the accuracy of the data contained herein. This material has been prepared and is distributed solely for informational purposes only and is not a solicitation or an offer to buy a security or instrument or to participate in any trading strategy. This report may not be reproduced, distributed or transmitted, in whole or part, by any means, without written permission from TWM. If you have any questions regarding this presentation, please contact your TWM representative.

Image source: “Reasons to Sell” with data from S&P 500 Total Return.