Navigating Volatile Markets: Principles and Positioning

So far in 2025, we have seen significant volatility in capital markets, extreme levels of uncertainty, and large fluctuations in investor sentiment. Back in April, we shared our insights on swings in the stock market and how things had changed since the start of the year. You may be asking now, “What does this mean for my portfolio?”

The answer is more complex than one may think.

Our team at Tolleson remains steadfast in the belief that investing is a long-term endeavor and should be measured over an extended period of time. Although this year may feel turbulent, it represents a comparatively brief timeframe in the context of investment strategy.

The U.S. stock market (as measured by the Russell 3000) experienced a peak-to-trough decline this year from mid-February through early April of -19.2% and had an annualized return of +14.0% since the start of 2020 through July 31. Looking back at the last five years, we’ve seen many fluctuations including a -35% drawdown in 2020 due to the global recession caused by Covid, a -25% drawdown in 2022 due to the Fed’s rate hiking cycle which spiked recession fears, and a -19% drawdown during this year.

From the start of 2000 through the end of 2024, the Russell 3000 has produced an annualized return of +7.8%. However, the average intra-year drawdown over that 25-year period is -15.5%. Volatility is a normal part of investing and maintaining a long-term mindset is crucial.

History continues to show us that it is prudent to maintain investment allocations through a turbulent market. By not overreacting to short-term fluctuation, a diversified investment portfolio usually leads to the best long-term outcome.

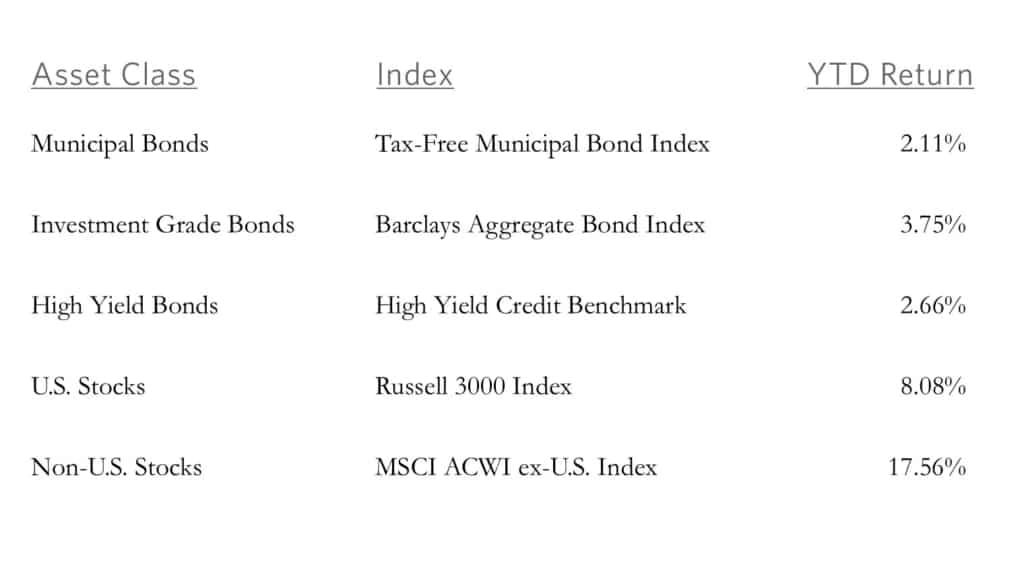

We also believe in the importance of portfolio diversification to help navigate a volatile market and different asset classes can offer correlation advantages. In a diversified portfolio, when stocks decline, fixed income may retain or increase its value. This approach has been continually effective, showing the same outcome for this year. For example, while the U.S. stock market has experienced massive volatility and a large drawdown followed by a recovery, bonds have all produced positive returns through the end of July. International stock markets have also produced solid returns year-to-date.

Portfolio diversification has helped dampen the volatility witnessed in U.S. markets, providing meaningful downside protection. In certain asset classes, active management can help to navigate turbulent market environments. Our team works strategically with third-party managers on changing market conditions to assess what portfolio adjustments need to be made.

In fixed income, our managers evaluate company risks and the economy’s outlook, relying on fundamental credit research to select bonds with strong risk/return profiles and minimal default risk. For equities, we use active management in inefficient markets, targeting small/mid-cap U.S. stocks and international developed or emerging markets, where managers leverage research and real-time assessments to react to changing conditions.

Market volatility is challenging, but it can offer good opportunities for patient investors. At Tolleson, we consistently utilize core investment philosophies including maintaining a long-term perspective, constructing diversified strategies, and implementing active management when needed. These continue to hold true as we experience shifts in the market and navigate future uncertainty and opportunity.

General Performance Information: The performance results included in this presentation are actual returns which have been compiled by Tolleson Wealth Management (“TWM”). Individual investor returns may or may not be similar to the returns shown. The returns shown are based on index information and are strictly for illustrative purposes only. An investor cannot invest directly in the index shown. Investors should refer to their account statements for their actual return. Returns of this type may not show what impact material economic and market factors may have had on TWM’s decision-making at that time. Past performance is no guarantee of future results. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. All investments involve risk, including the loss of principal. These returns do not account for manager or other advisory fees that will impact a client’s overall return. A client’s return will be reduced by advisory and other expenses. TWM’s advisory fees are described in Part 2a of our Form ADV. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Opinions expressed are current opinions as of the original publication date appearing in this material only. Any opinions expressed are subject to change without notice and TWM is under no obligation to update the information contained herein. TWM disclaims responsibility for the accuracy or completeness of this report although reasonable care has been taken to assure the accuracy of the data contained herein. This material has been prepared and is distributed solely for informational purposes only and is not a solicitation or an offer to buy a security or instrument or to participate in any trading strategy. This report may not be reproduced, distributed or transmitted, in whole or part, by any means, without written permission from TWM. All portfolio and analysis herein constitute confidential and proprietary information and methodology of TWM. Disclosure of such information is prohibited. If you have any questions regarding this presentation, please contact your TWM representative.

Index Disclosure: The returns and volatility of the indices displayed may be materially different than the client’s account, and a client’s holdings may differ significantly from the securities that comprise the indices. The indices are disclosed to allow for comparisons to well-known and widely recognized indices, and may or may not be appropriate for performance comparisons. An investor cannot invest directly in the index.