When Narratives Break: Investing in an Event-Driven World

In the 1950s, when asked what the greatest challenge to his administration’s plans might be, U.K. Prime Minister Harold Macmillan famously replied, “Events, my dear boy, events.”

I’m reminded of this line every January as I read the new year’s batch of economic and market outlooks published by large banks and Wall Street research firms. These reports—often exceeding 100 pages—are filled with economic forecasts, scenario analysis, and earnings estimates, all projecting a sense of precision about a future that is inherently uncertain.

This time last year, American Exceptionalism was the dominant theme across many of those outlooks. Expectations around tax cuts, deregulation, and government spending reform boosted earnings forecasts, which reinforced the belief that U.S. stocks would continue to outperform international markets in 2025. By early April, US stocks were down -15% as markets scrambled to re-price the impact of Liberation Day tariffs. Suddenly, American Exceptionalism was no longer a baseline assumption—it became a debate. Concerns mounted that tariffs would stall growth, reignite inflation, and tip the global economy into recession.

Yet, corporate earnings released over the summer proved resilient. An unprecedented surge in capital expenditure (capex), driven by artificial intelligence (AI) growth outlooks, shifted the prevailing narrative from fears of an economic recession to fears of a stock market bubble. Sentiment oscillated between enthusiasm and anxiety for the remainder of the year as policy, geopolitics, and AI investment repeatedly reset expectations. When the dust settled, U.S. stocks posted a remarkable gain of 17.9% for the year while international stocks outperformed by a factor of almost 2x, returning 32.4%.* Perhaps Macmillan was onto something.

Turning the page to 2026, the Department of Justice has subpoenaed the Federal Reserve Chair, and the United States has floated a bid to buy Greenland—all occurring before we hit February.** Rather than trying to forecast what comes next, I find it more useful to step back and consider what 2025 taught us about how markets respond to a series of repeated and unpredictable “events.”

Lesson 1: Markets Follow Capital, Not Narratives

In the short term, market narratives can change quickly. Over time, however, equity prices remain anchored to earnings—and, critically, to management guidance around the durability of future earnings. In 2025, that anchor was shaped by the scale and concentration of capex directed toward AI infrastructure.

Capital spending did not slow in 2025; it concentrated. A small group of hyperscale technology companies accounted for the overwhelming share of incremental investment, directing hundreds of billions of dollars toward data centers, advanced semiconductors, networking equipment, and power infrastructure. This spending supported earnings both directly and indirectly, bolstering the broader technological ecosystem while offsetting macroeconomic headwinds.

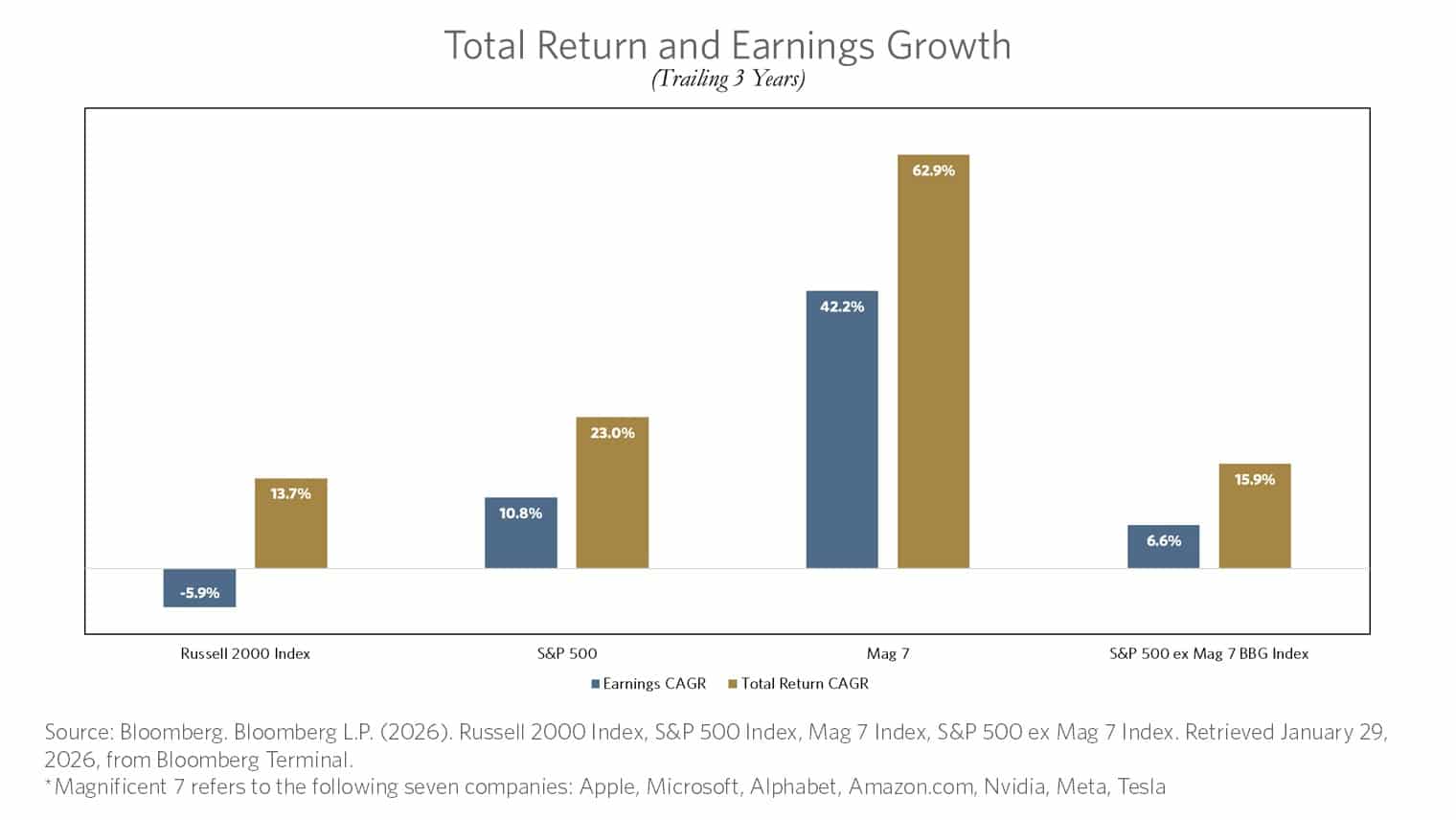

The result was a pronounced divergence in earnings and market performance. Companies driving AI-related investment delivered materially stronger earnings growth and total returns than the rest of the market—reinforcing that market leadership was rooted in fundamentals rather than narrative.

The earnings impact of AI investment flowed through the market in stages. Semiconductor manufacturers and data-center infrastructure providers were early beneficiaries. Software and cybersecurity companies followed as enterprises invested in deploying and securing AI capabilities. Over time, third-order effects began to emerge in the form of productivity gains, margin stabilization, and labor substitution.

Lesson 2: From Trend-Following to Event-Driven Markets

Investors often feel compelled to hold a definitive view on every variable, leading to straight-line forecasts in a non-linear world. Periods dominated by policy shifts, geopolitical tension, and rapid technological change expose the limits of trend-based forecasting. AI represents a platform shift that accelerates timelines rather than extending existing trends. With capital deployed ahead of visible demand, productivity gains arrive unevenly, and competitive advantages compound quickly. NVIDIA provides a useful illustration. At the end of 2015, the company was valued at roughly $18 billion and widely viewed as a niche supplier to the gaming industry. By the end of 2025, its market capitalization had grown to approximately $4.5 trillion, becoming central to the global AI buildout.*** No conventional forecasting model could have predicted revenue expanding nearly 28x and equity value soaring more than 250x in only 10 years.

What mattered in 2025 was not the absence of shocks, but the presence of cushions. Large-scale investment in AI infrastructure, improving productivity, and fiscal support boosted share prices of companies deemed to be AI beneficiaries and helped absorb repeated blows in other sectors of the market. Rather than bending trends temporarily, shocks were repeatedly offset by capital allocation decisions that stabilized earnings and cash flow at the index level.

This reset was visible not only in markets, but in the real economy as well. Employment growth over the past several years has become increasingly concentrated among large firms, while small and mid-sized businesses struggled to expand payrolls. Companies with scale and access to capital continued to hire, while smaller firms faced tighter constraints.

What’s Ahead

Looking forward, the market’s focus has shifted from how much was spent to how spending evolves. To justify current valuations, investors need either (1) continued growth in AI-related capex in 2026 or (2) clear evidence that earnings growth is beginning to broaden beyond a narrow group of market leaders.

The next phase of the bull market does not require higher capex; it requires broader capex. Either investment diffuses into adopters and downstream beneficiaries, or earnings growth remains disproportionately dependent on a few players. In an environment defined by uncertainty, guidance – and not just reported results—has become one of the most important signals markets receive.

Events will continue to intervene. Forecasts will change. Narratives will rotate. In an environment shaped by frequent shocks and rapid technological change, the advantage does not belong to those with the most precise outlooks, but to those with the most disciplined frameworks.

As we move through 2026, the challenge for investors is not to predict the next event, but to remain focused on the fundamentals that endure when the noise fades: where capital is being committed, where earnings are compounding, and where expectations are quietly becoming too optimistic.

Sources:

- *MSCI. (2026). MSCI ACWI ex USA Index (Index Code: 899901). Retrieved from https://www.msci.com/indexes/index/899901. Bloomberg L.P. (2026). SPX S&P 500 Index. Retrieved January 30, 2026, from Bloomberg Terminal.

- **Powell, J. (2026, January 11). Statement from Federal Reserve Chair Jerome H. Powell. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/newsevents/speech/powell20260111a.htm. Kirchgaessner, S., & Hubbard, B. (2026, January 7). Buy Greenland? Take It? Why? An Old Pact Already Gives Trump a Free Hand. The New York Times. https://www.nytimes.com/2026/01/07/world/europe/trump-greenland-denmark-us-defense-pact.html

- ***Bloomberg L.P., NVDA market capitalization data (2015–2025), retrieved via Bloomberg Terminal.

General Performance Information: The performance results in this presentation have been compiled by Tolleson Wealth Management (“TWM”). Past performance is no guarantee of future results. No representation is being made that any account will or is likely to achieve profits or losses. All investments involve risk, including the loss of principal. A client’s return will be reduced by the advisory fees and other expenses. TWM’s advisory fees are described in Part 2a of our Form ADV. This information discusses general market activity, industry or sector trends, or other broad-based economic market or political conditions and should not be construed as research or investment advice. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Opinions expressed are current opinions as of the original publication date appearing in this material only. Any opinions expressed are subject to change without notice and TWM is under no obligation to update the information contained herein. TWM disclaims responsibility for the accuracy or completeness of this report although reasonable care has been taken to assure the accuracy of the data contained herein. This material has been prepared and is distributed solely for informational purposes only and is not a solicitation or an offer to buy a security or instrument or to participate in any trading strategy. This report may not be reproduced, distributed or transmitted, in whole or part, by any means, without written permission from TWM. If you have any questions regarding this presentation, please contact your TWM representative.

Index Disclosure: The returns and volatility of the indices displayed may be materially different than the client’s account, and a client’s holdings may differ significantly from the securities that comprise the indices. The indices are disclosed to allow for comparisons to well-known and widely recognized indices and may or may not be appropriate for performance comparisons. An investor cannot invest directly in the index.